39 gst on antivirus software

GST on Anti-virus - IceInSpace GST on Anti-virus our illustrious (not) leaders changed the law a little while back so that software from overseas now attracts 10% GST.. So, as people seek to protect themselves from virus attacks by installing/updating their anti-virus software... you got it, you'll be charged 10% for the privilege... # 2 17-07-2017, 04:25 PM xelasnave K7 Ultimate Security Infiniti, Unlike other Antivirus ... K7 Infiniti is designed to be as easy to use as possible, and works quietly in the background without ever affecting your system's performance. Users can get an overview of the product's features from the home screen in the K7 Antivirus client. K7 Infiniti is designed to be as easy to use as possible, and works quietly in the background without ever affecting your system's …

software HSN Code or HS Codes with GST Rate Description GST% 49070030 DOCUMENTS OF TITLE CONVEYING THE RIGHT TO USE INFORMATION TECHNOLOGY SOFTWARE 12% HSN Code 4911 Printed matter, incl. printed pictures and photographs, n.e.s. HS Code Description GST% 49119910 HARDCOPY(PRINTED)OF COMPUTER SOFTWARE ,Products include: Computer Stware, Computer Stware 12% HSN Code 8523

Gst on antivirus software

Top 16 Supermarket Billing Software in India for Inventory ... Nov 24, 2020 · A GST compliant software, it can also be used to obtain tax breakup. The software is packed with modern-day features such as support for multiple payment methods including online wallets. Features of Ginesys D Mart Billing Software. Multiple selling prices ; You have the option of managing different selling price of items present in the stock. Syslive Network - Wholesale Trader of Antivirus Software ... Antivirus Software, Adobe Softwares & Microsoft Software Wholesale Trader offered by Syslive Network from New Delhi, Delhi, India Syslive Network New Delhi, Delhi GST No. 07DWCPS3258B1ZL Install AccountRight - MYOB AccountRight - MYOB Help Centre Some antivirus software can interrupt software installation. If you have issues installing, try temporarily disabling your antivirus software and enable it again after installing. If you need some more installation help, see Installation troubleshooting. ... BAS / GST return ...

Gst on antivirus software. ESET Antivirus and Internet Security Software. Don’t Get ... Get ESET antivirus and Internet security for Windows PC, Android, Mac or Linux OS. ... Prices include GST. Award-winning cybersecurity technology. ... ESET Software Australia Level 20, 111 Pacific Highway, North Sydney, NSW 2060 Sydney, Australia Phone: 1300 084 040 Tally.ERP 9: Gold- GST Ready (Multi User- Unlimited LAN ... GST-ready Tally ERP 9 allows to generate GSTR-1, GSTR-3B and GSTR-4 from within the product itself. You can go to the respective GSTR reports, apply corrections to vouchers that appear in incomplete/mismatch of information and export the same to in JSON format and upload it directly in the GST portal, or you can export in Excel offline utility ... CMP Benefits – CMP Benefits Antivirus Protection Facility. Arrangement GST Annual Return Software for Members in Practice/CA Firms. Coming Soon. Arrangement All-in-One accounting’ software. Arrangement for Eff Factor Software Practitioners & CA Firms ... TDS on Annual Subscription License Fee for Software GST Payer. watch_later 14/11/17. thumb_up 0 thumb_down. Income tax under section 194C is deducted (TDS) when there is any contract for provision of service and 194J which is for technical services. In case of sale or purchase of software both these conditions are not meet and hence there is no liability to deduct tax.

List of Overseas Subscriptions Services Products with GST ... Jul 01, 2018 · List of Overseas Subscriptions with GST and ABN; With the introduction of the new rules to GST on Digital Subscriptions, Goods and Services supplied to Australia, it is very important not to miss the GST and claim it correctly. Not all suppliers are registered for GST in Australia. GST on Import of Software - TaxGuru The GST rate for software sold in physical form is also 18%. The above stand on software has been clarified and confirmed by various Courts. In the case of Tata Consultancy Services v. State of Andhra Pradesh, it has been held that canned software which is sold in packages or CDs or DVDs or USB Drivers will be classified as goods. HiFi-Technologies-Amritsar Softwares We Provide, Web Application Development, Software development, ERP Service, Gst and Accounts Softwares, E-Commerce Solutions, Mobile Apps, Data Security and many more. Photo Copy Machines We provide all type of photocopy machines, Printers, new Cartridge, fill old cartridge etc. Security Solutions GST-VAT INVOICING (free version) download for PC GST-VAT INVOICING is included in Business Tools. Our antivirus check shows that this download is safe. This software was originally designed by OWL Software. The file size of the latest downloadable installation package is 811 KB. Gvi.exe is the common file name to indicate this program's installer.

Gen-GST (free version) download for PC Gen-GST 1.0.0.29 is free to download from our software library. The program belongs to Business Tools. The following version: 1.0 is the most frequently downloaded one by the program users. Our antivirus scan shows that this download is clean. Gen-GST can be installed on Windows XP/7/8/10 environment, 32-bit version. List of Goods and Services Not Eligible for Input Tax ... 12.07.2020. Sir., Can we take GST ITC on Security service charges as per below actual bill working: Billno.1/30.04.2020. Security service charges (2 security for office purpose) Rs.10000/-(Taxable value) Tax Treatment of Imported Computer Software - Canada.ca the full value of the software is subject to the GST under Division III at the time of importation; the tax is paid by the importer (usually the Canadian customer). Software terminology The term "off-the-shelf" software is used to indicate pre-packaged, commercially-available software programs, such as, WordPerfect or Lotus 1-2-3. GST Certification Course & Online Training Classes ... Join our GST training session, online class & certification course and get trained on how to apply for a GST certificate, create GST invoice, claim ITC and file GST returns. Course contains E-Learning class with downloadable video lectures, E-Books and course completion certificate on Goods and Service Tax of India

GST Rate for IT Services (Software) | Ministry of ... Single GST Rate for IT Software: GST rate for all kinds of IT Software supply: services, products, supply on media, electronic download and temporary transfer of Intellectual Property (IP) is 18% with full Input Tax Credit(ITC). For more details

Dangers Of Using Pirated Software - Bitdefender Dangers of using pirated software. As software prices increase, many users turn to installing bootleg copies, or pirated ones. We'll tell you what dangers you may come upon if you're using pirated copies. The first risk that you run is infecting your PC. The crack might actually be a poorly disguised malware.

6 Important Features To Have in Your GST Software - QuickBooks This article talks about important features that a GST Software must have. Features in GST Software 1. GST Ready Invoices Taxpayers registered under GST need to generate invoices as per the GST format. A GST compliant invoice includes details such as: GSTIN of the supplier and the recipient HSN/SAC Codes

List of GST Free Suppliers (Australia) PLEASE NOTE: These online suppliers charge Australian GST Amazon (from 1st July 2017 will include GST) Avast anti-virus software (includes GST). You may see on your credit card statement a charge from "Digital River". Bing/Microsoft advertising (not sure of the exact date but we have an invoice from Sept 2015 that includes GST.)

Locate the receipt for purchase made from Norton.com or ... The confirmation email that you received for automatically renewing subscription is the receipt for your purchase. Check your inbox or the spam folder for the confirmation email.

Antivirus Software and Information Technology Service ... GST Number 30AGTPJ7364F1Z9 Products & Services Antivirus Software Trend Micro Antivirus Plus 1 Year 3 PC - Key Digital Delivery Only Trend Micro Titanium Maximum Security 2018 1 Year 3 PC - Digital Delivery Key Trend Micro Internet Security 1 Year 1 PC - Digital Delivery Key View Details Information Technology Service Bulk SMS Service In India

Kaspersky Antivirus - Buy Kaspersky Total Security Online ... Kaspersky Antivirus Online at Flipkart. Kaspersky Lab is a Russian multinational company dealing with computer security . Kaspersky Lab develops secure content and threat management systems and it is the world's largest privately held vendor of software security products.

TallyPrime Silver - one software for all your business needs - Accounting, GST, Invoice, Inventory, MIS & more

13 Best Free GST Billing Software - Free Download and Demo Tally.ERP 9 is one of the best GST software for Indian businesses. It adheres to all the Government's GST-related compliances to provide accurate invoices. In addition, it also helps in other modules related to, accounting, inventory, banking, and payroll. Tally.ERP 9 is suitable for SMEs as well as enterprises. Features of Tally.ERP 9: Accounting

Tax on Digital Services in India: GST Applicability and ... A GST levy of 18 percent is applicable on sale of digital services in India in both the following cases. OIDAR service providers located in India: They must file GSTR-1, GSTR-2, GSTR-3 and annual GST return like a regular taxpayer. OIDAR service providers located outside India: They are required to file Form GSTR-5A on or before the 20th of ...

Is SaaS (Software as a Service) Taxable in Canada? Two factors decide if your digital business is going to be taxed or not. 1- The location of your business 2- The province where your customer lives. Conclusion There is not one single rule of digital tax which could be applied all over Canada. The tax depends on the location of your business and the customer.

Shweta Computers – Buy Best Laptops, Computers, Gaming ... Desktop Apple iMac (MHK03HN/A) Core i5 7th Gen macOS All-in-One Desktop (8GB RAM, 256GB SSD, Intel Iris Plus Graphics 640, 54.61cm, White) ₹ 99,900.00 inc. GST

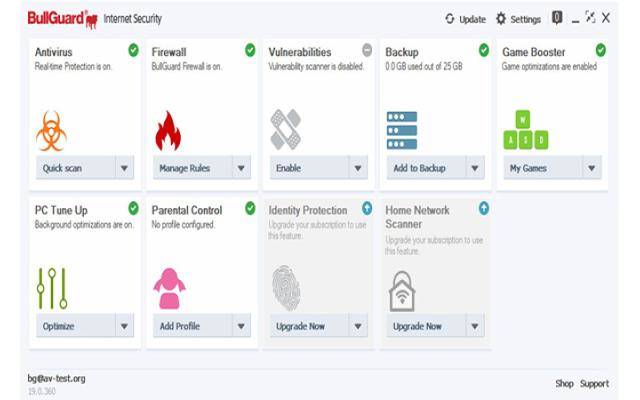

Install AccountRight - MYOB AccountRight - MYOB Help Centre Some antivirus software can interrupt software installation. If you have issues installing, try temporarily disabling your antivirus software and enable it again after installing. If you need some more installation help, see Installation troubleshooting. ... BAS / GST return ...

Syslive Network - Wholesale Trader of Antivirus Software ... Antivirus Software, Adobe Softwares & Microsoft Software Wholesale Trader offered by Syslive Network from New Delhi, Delhi, India Syslive Network New Delhi, Delhi GST No. 07DWCPS3258B1ZL

Top 16 Supermarket Billing Software in India for Inventory ... Nov 24, 2020 · A GST compliant software, it can also be used to obtain tax breakup. The software is packed with modern-day features such as support for multiple payment methods including online wallets. Features of Ginesys D Mart Billing Software. Multiple selling prices ; You have the option of managing different selling price of items present in the stock.

0 Response to "39 gst on antivirus software"

Post a Comment